What is Copy Trading?

Copy trading is a trading strategy that allows individuals to automatically replicate the trades of experienced traders in the forex market. This approach offers an accessible way for novice investors to engage in forex trading without the need for extensive knowledge or experience. The basic principle of copy trading involves a follower, or a trader looking to benefit from others’ expertise, selecting a more experienced trader to emulate. Once this selection is made, any trades executed by that professional trader will be mirrored in real-time on the follower’s trading account.

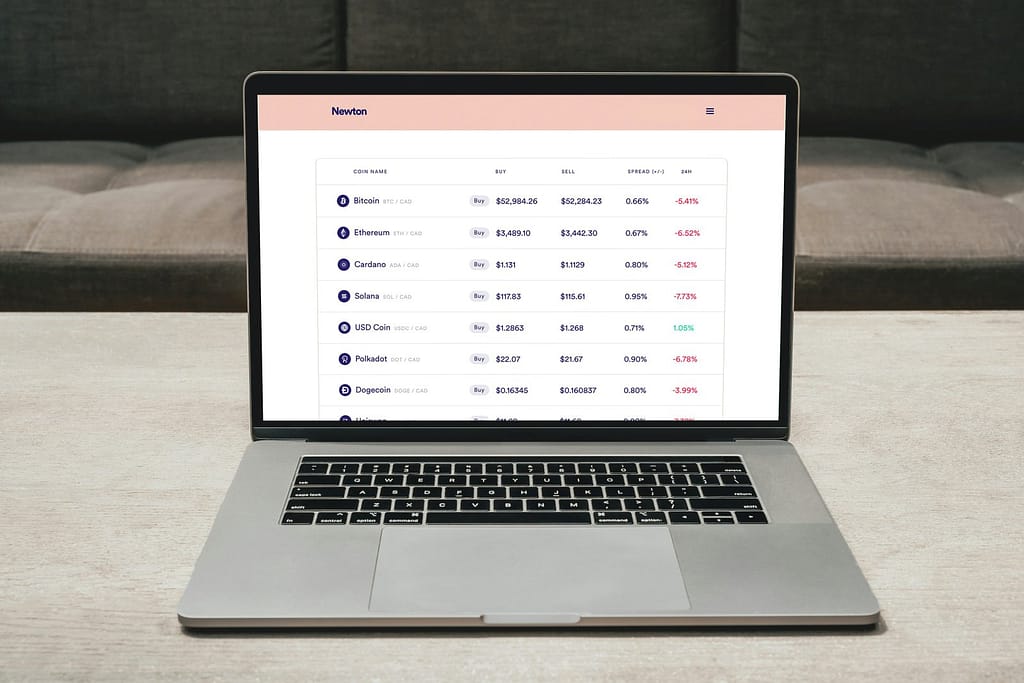

The mechanism operates through specialized trading platforms that support copy trading functionalities. These platforms provide a comprehensive performance record for potential lead traders, allowing followers to assess aspects such as profitability, risk levels, and trading style before making their decision. By offering transparency, these platforms enable users to make informed choices regarding which traders they wish to follow.

In essence, copy trading acts as a bridge between seasoned traders and those less familiar with the complexities of the forex market. The role of the traders is twofold; they not only execute trades based on their analysis and strategies but also serve as a beacon for followers seeking guidance. As transactions are mirrored, the follower benefits directly from the lead trader’s expertise, resulting in a potentially profitable trading experience.

It is crucial to note that while copy trading offers opportunities for profit, it also carries risks. The performances of lead traders are not guaranteed, and followers should be aware that past success does not assure future results. Understanding the dynamics of copy trading within the forex market is essential for anyone considering this investment strategy.

The Benefits of Copy Trading in Forex

Copy trading in the Forex market is increasingly becoming a favored approach among both inexperienced and seasoned traders. One of the most significant advantages of this trading strategy is its ability to reduce the learning curve for novices. By enabling new traders to mirror the actions of more experienced professionals, they can gain insights into technical analysis, timing of trades, and market behavior without needing to have extensive knowledge or expertise in the field. This allows beginners to participate in Forex markets more confidently and efficiently.

Additionally, copy trading provides diversification benefits. By following multiple traders with varying strategies, risk appetites, and market focuses, traders can spread their exposure across different asset classes and market conditions. This diversification can help reduce overall risk and enhance the potential for profit, as it minimizes the reliance on any single investment or trading strategy.

For experienced traders, copy trading serves as a platform to monetize their trading skills. Those with a successful track record can profit from their expertise by allowing others to copy their trades for a fee or a percentage of the profits generated. This not only provides a passive income stream for skilled traders but also helps to build a community where knowledge and strategies can be shared, ultimately benefiting all participants involved.

Real-world examples highlight these benefits effectively. For instance, a novice trader who followed a successful trader specializing in currency pairs could quickly learn effective entry and exit strategies, contributing to their growth and understanding of the market. Simultaneously, the professional trader sees financial rewards for their expertise. Overall, copy trading in Forex is a multifaceted approach that fosters learning, diversification, and monetization opportunities in the dynamic trading landscape.

Risks and Challenges of Copy Trading

Copy trading, despite its growing popularity in the forex market, carries certain risks and challenges that traders must consider before engaging in this practice. One significant concern is the reliance on the performance of other traders. When a trader chooses to copy the trades of another, they primarily delegate their trading decisions to someone else. This creates a potential risk, as the success of their investments directly depends on the selected trader’s skills and strategies. If the trader being copied makes poor decisions, the follower may incur substantial losses.

Additionally, the forex market is inherently volatile, with prices fluctuating rapidly due to numerous external factors such as economic data releases, geopolitical events, and market sentiment shifts. Thus, even experienced traders can face unpredictable outcomes. Such volatility can amplify the risks associated with copy trading, as followers may find themselves unprepared for sudden market movements that negatively impact their investments.

Choosing the right traders to copy is another critical challenge in the copy trading landscape. Many platforms offer the ability to review the past performance of potential traders. However, it is essential to recognize that past success does not guarantee future results. A trader’s effectiveness can change due to various reasons, including alterations in market conditions or shifts in their personal trading strategies. Therefore, conducting thorough due diligence and continuously monitoring the performance of the traders being copied is vital to mitigate these risks.

Moreover, emotional detachment is an often-overlooked aspect of copy trading. Traders may find it challenging to remain objective as they witness the ups and downs of their investments tied to another’s decisions. This emotional involvement can lead to impulsive actions, such as prematurely terminating a copy relationship or overreacting to short-term losses, ultimately undermining the benefits of copy trading. Recognizing these pitfalls and exercising caution is essential for anyone considering copy trading in the forex market.

Getting Started with Copy Trading in Forex

Copy trading in forex offers an accessible entry point for new traders looking to engage with the financial markets by leveraging the expertise of seasoned investors. To get started, it’s essential to follow a structured approach.

First, selecting a reliable trading platform is crucial. Look for platforms that facilitate copy trading and provide detailed information about the traders you may wish to follow. Popular platforms often include social trading features, allowing traders to showcase their performance and strategies transparently. Make sure the platform you choose is regulated and offers a user-friendly interface to ease your trading experience.

Once you have a platform, the next step involves identifying successful traders to copy. It is beneficial to research the track records of various traders, evaluating factors such as their return on investment (ROI), risk levels, and trading strategies. Look for traders whose styles align with your investment goals. Some platforms allow you to filter traders by specific criteria, including performance metrics or trading pairs they specialize in.

The amount you wish to invest should be considered carefully. Initial investments can vary, so it’s prudent to start with an amount you can afford to lose. Many platforms have minimum investment requirements, but remember to diversify your investments across multiple traders to spread risk.

As you begin to copy trades, it’s essential to monitor your portfolio’s performance closely. Different markets can fluctuate significantly, so stay informed about market conditions and adjust your strategies accordingly. Additionally, be aware of any trading fees associated with the platform or specific traders, as these can impact your overall profitability.

In summary, starting with copy trading in forex requires careful platform selection, thorough research on traders, prudent investment decisions, and ongoing performance evaluation. By following these steps, you may enhance your trading experience and investment outcomes.